Area Managing Partner/CMO

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

Ditch the funnel sales model for go to market

4 steps for manufacturers to move from funnel to pipeline model and lead to better results

- By Mark Coronna

- October 6, 2020

- Article

- Shop Management

The traditional concept and application of a sales funnel is very flawed. The new, intelligent pipeline model takes a proactive approach and places more emphasis on quality versus quantity to improve sales metrics. Getty Images

The model of a funnel to represent how leads convert to sales is credited to a gentleman named E. St. Elmo Lewis, who devised it in 1898. It is ripe for improvement. Would you use 1898 manufacturing technologies to do business today? It would be amazing for a technology or business model to remain unchanged 120 years later.

As manufacturers, you are leaders in continuous improvement, process automation, and deployment of more effective equipment. You eat, think, and breathe operational excellence.

There’s a way to apply operational excellence to the go-to-market side of your business. This approach, called the Intelligent Sales Pipeline, is a new way to proactively manage lead generation and lead qualification using prospective customer data, intelligence, engagement, and metrics—none of which were around in 1898.

Problems With a Traditional Sales Funnel

As a process, the traditional concept and application of a sales funnel is very flawed. Effective and efficient processes have short cycles and, therefore, operate at lower costs as they deliver quality results. They have high throughput and productivity. They produce known results and so future revenues are easier to forecast. They are operationally excellent in their structure and results.

Typical problems with sales funnels are:

Time. Buyers don’t necessarily want to follow your process or wait for you to encourage their movement and buying journey, and their buying cycles are shorter.

Sequence. Today’s buyer journey is anything but linear or one way. It jumps around as new information is introduced.

Quantity, Cost. Acquiring a mass of unqualified leads just won’t work economically today, even if you get them inexpensively.

Lead Quality. A funnel model results in low sales productivity. Only after wasting time screening inquiries can you weed out poor-quality prospects.

Control. While you can influence through education and insight, you can’t dictate what options your buyers are considering or competitors’ prices.

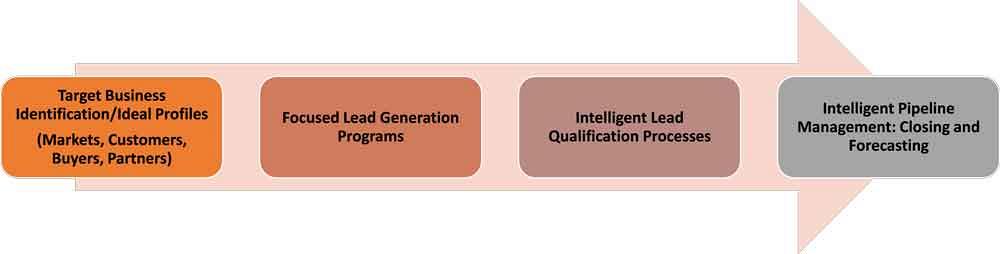

The Intelligent Sales Pipeline model follows a linear approach, starting with identifying your target business, then focusing on lead gen before qualifying the lead and closing.

Capacity Forecasting. When you keep filling funnels beyond their size and capacity with what many of us know as “junk in, junk out” approaches, this makes the funnel less predictive of the future growth of the business.

Introducing the New Pipeline Model

This model operates very differently than the traditional funnel model. Today selling is much more of a conversion process, built on a level of intelligence-gathering and engagement.

Intelligence. The intelligent part of the new model is that it is a proactive process of identifying prospects in a more effective way, based on prospect-focused engagement.

Engagement. Building rapport and a deeper understanding of pain points, needs, challenges, and goals through deeper interaction with a smaller number of prospects leads to better results.

Metrics. Starting with higher-quality, better-fitting prospects at the beginning of your interaction and placing more emphasis on quality versus quantity improve sales metrics.

The following are the key components of the new, intelligent pipeline model:

1. Identify Target Business

The model starts with identifying your ideal customer and buyer. Ideal buyers are the individuals in those ideal customer companies you want to cultivate. Profiles often include factors such as:

Demographics

- Size and growth: revenue, employees

- Location, scope: local, regional, national, global

Strategic Fit Factors

- Match with your value proposition

- Fit with capabilities, product, and service offerings

- Long-term potential (transactional versus relationship buyers)

- Profitability (ability to meet target margins)

Buying Factors

- Openness to discuss projects, share concerns, discuss options

- Purchase process (length, involvement, individual or group)

Ideal buyer profiles represent specific roles within the prospect’s organization for your sales team to focus on. Some of these roles or people have more influence and decision-making authority than others. An important task is understanding the various stakeholders involved in making what is often a collective decision on a complex service or product. Each stakeholder may vary in influence, and it might be difficult to identify a decision-maker.

Figure 2

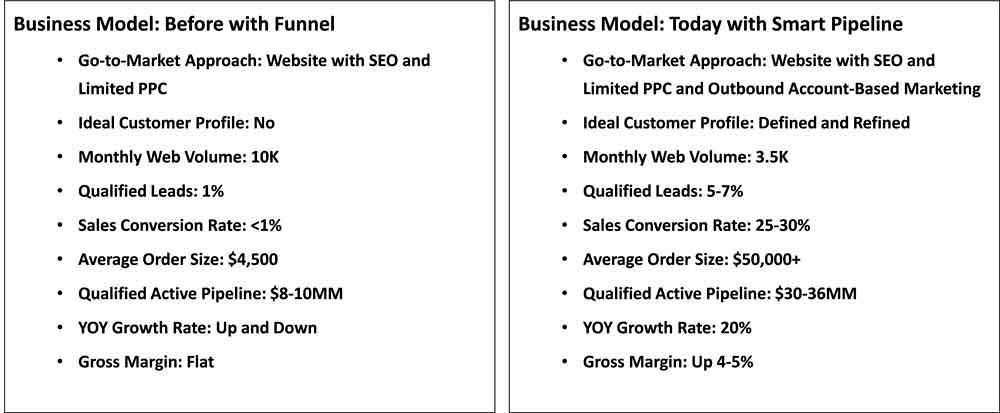

A Smart Pipeline sales approach can yield more qualified leads, larger average order sizes, and higher gross margins.

Typical influencers and buyers for a manufacturer’s products often are vice presidents of engineering, COO/vice presidents of operations, vice presidents of product design/development, and vice presidents of procurement and supply chain management.

An Intelligent Sales Pipeline approach starts by understanding which organizations make for the best business relationships. This places significant emphasis on prequalifying prospects.

2. Focus on Lead Generation

Focused, proactive lead generation starts with these four questions—and the last three are much more important than the first one:

- What markets should we be in, based on their size, growth, and competitive coverage?

- Are these good markets for us, and can we win?

- Can we find our ideal customers and buyers in these markets?

- Can we find our ideal customers efficiently and effectively?

If you have answered these four questions affirmatively, then you’re ready to design a proactive go-to-market plan. By proactive, we mean an intentional plan to identify your ideal customers and buyers and communicate with them effectively. This is the first step in implementing an Intelligent Sales Pipeline.

Prequalification is a critical step. If you have identified your target business and focused your lead generation program, then you have already defined with whom you want to do business. Instead of dumping a large quantity of unqualified leads into this pipeline, you carefully curate leads that match your ideal customer profile and introduce them into the process.

An effective website is only one source of prospects. It is not optimal for hosting qualifying conversations. Creating and maintaining a best-in-class website with highly relevant content and search engine optimization is the foundation for all good go-to-market programs. But it alone is insufficient, because it relies on your target customers to find you through their search actions.

There are many ways of being proactive beyond your internet marketing initiatives. One of the best ways is to implement an account-based marketing program. These marketing programs start with your ideal customer and buyer profiles and use a third party to contact and qualify leads.

As you improve your target profiling, the quality of your lead stream will improve. Your focus should be on quality over quantity. Your sales team will be much happier not having to screen out poor-quality prospects and their productivity will improve.

3. Qualify Leads

The traditional way of qualifying leads was based on tasks. Often an organization’s customer relationship management platform embeds this approach.

In task-based qualification, every task completed until a prospect is closed as a customer is given a percentage score. For example, an initial verbal qualification of an order worth $1 million may be assessed at 10%; if you give a prospect a demo, it might be assessed at 50%; and when you receive a request for quotation, it might be 70%. However, this method of scoring may be misguided, because the deal is worth nothing if you lose it, or it will be worth $1 million if you win it. It will never be worth $500,000 unless it is broken into individual orders.

Conversely, using the Intelligent Sales Pipeline model, you qualify and score prospects based on their answers to the factors mapped out in the ideal customer profile.

4. Close and Forecast

With improved qualification using the pipeline approach, your sales group will be able to have deeper, more valuable interactions with your best prospects. The qualification steps left to complete include qualifying budgets; qualifying the decision-maker and decision process (you have already identified the decision-maker through your ideal buyer profiling); and negotiating the final purchase price, terms, and conditions.

The efficiency and effectiveness of the new model comes through different indicators. The first indicator is how many active leads you have, measured as a percentage of qualified leads. You may be able to reach sales closing rates of 25% to 30%, which exceeds industry averages. You will also likely see increases in average order sizes.

Most significant, you are likely to see higher customer lifetime values, driven by longer-term, higher-margin business from each customer.

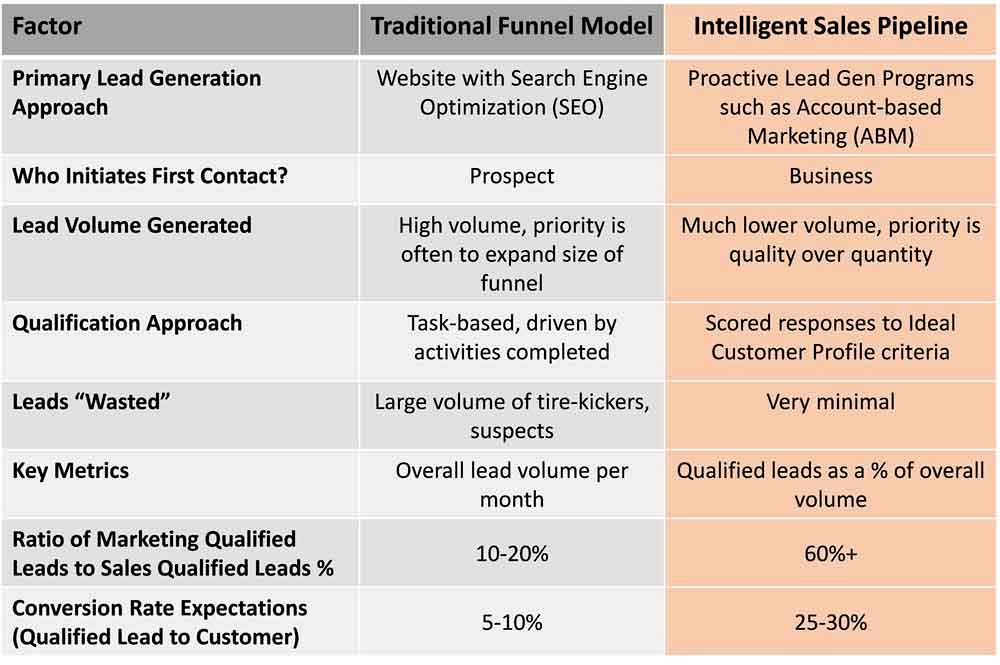

These types of metrics are paramount to measuring, managing, and predicting performance. Figure 1 compares the dynamics of the traditional funnel model and the Intelligent Sales Pipeline.

Does the Pipeline Approach Really Work?

The Intelligent Sales Pipeline drives the following advantages:

- Fewer nonqualified suspects or prospects to process

- Lower customer acquisition costs

- Dramatically improved sales productivity, revenue growth, and margin improvement

- Reduced time from prospect to closed customer

- Strong probability of higher customer lifetime value

Smart Sales Pipeline Case Example

Figure 2 displays a before-and-after example from Dalsin Industries, The FABRICATOR’s 2020 Industry Award winner.

Dalsin Industries Vice President of Sales and Marketing Tom Schmeling had this to say about the new approach: “When we started, we weren’t sure how this program would benefit us. Now, however, it has become a critical part of our go-to-market programs. Our program has a nice payback, which is important for a smaller company with resource constraints.”

Those types of results are there for you, too, if you are willing to bring operational excellence to your go-to-market programs.

Mark Coronna is area managing partner/CMO of Chief Outsiders

About the Author

Related Companies

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscription- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/30/2024

- Running Time:

- 53:00

Seth Feldman of Iowa-based Wertzbaugher Services joins The Fabricator Podcast to offer his take as a Gen Zer...

- Industry Events

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI

Precision Press Brake Certificate Course

- July 31 - August 1, 2024

- Elgin,